taxation:

a simple and unique system

Although the Polynesian tax system is distinguished by the absence of personal income tax, wealth tax and inheritance tax, other taxes do exist.

1. import duties and taxes

Import duties and taxes are collected by the Regional Customs Directorate, a state service made available to the territory for this fiscal mission. Goods of all kinds, from all origins, regardless of the mode of transport, must be declared upon arrival in French Polynesia to be subject to duties and taxes.

However, there are exemptions or suspensions of duties and taxes corresponding to targeted government policies (such as temporary admission regimes and investments in renewable energy).

2. Taxes, duties and levies affecting income

2-1. taxation on personal income

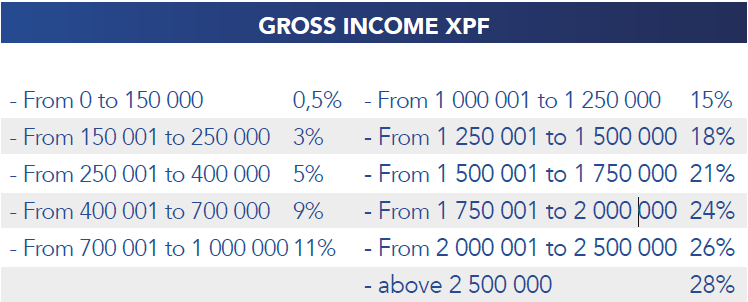

One of the unique features of the Polynesian tax system is the absence of tax on the total income of individuals. Salaries, wages, and pensions are simply subject to a Territorial Solidarity Contribution (CST) intented to fund the universal social protection system.

This contribution is subject to withholding at source by the employer or the income payer. Therefore, unless there are multiple sources of income, income earners do not have a filling obligation. The contribution is applied in income brackets, according to the following terms:

2-2. corporate taxation

2-2-1. general taxation

Business licence tax: an entry point into taxation

The business tax applies to all businesses, wether individual or legal entities, with the exception of activities in the primary sector, artistic creation, and those related to asset management. It is an annual flat fee consisting of a fixed portion based on the nature of the activity and a proportional portion, which is calculated by applying a rate to the rental value of the business premises.

Gross Revenue Tax: simplicity tailored for sole proprietorships

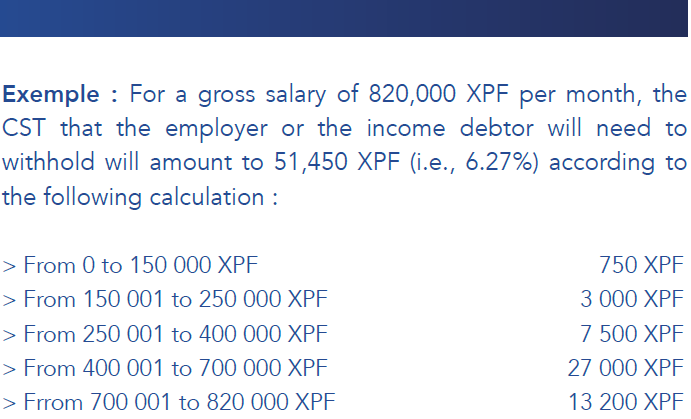

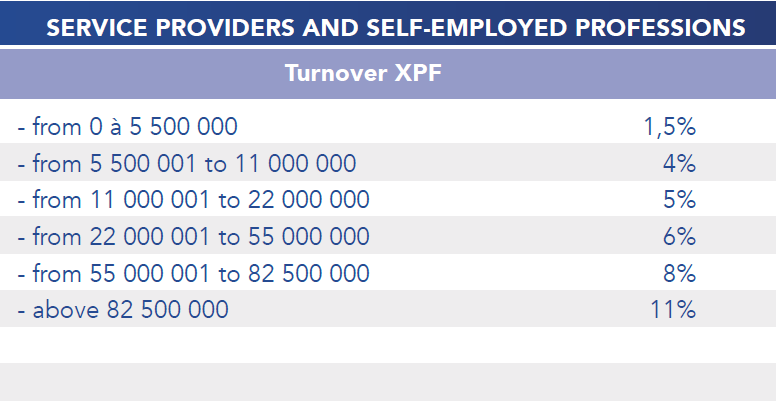

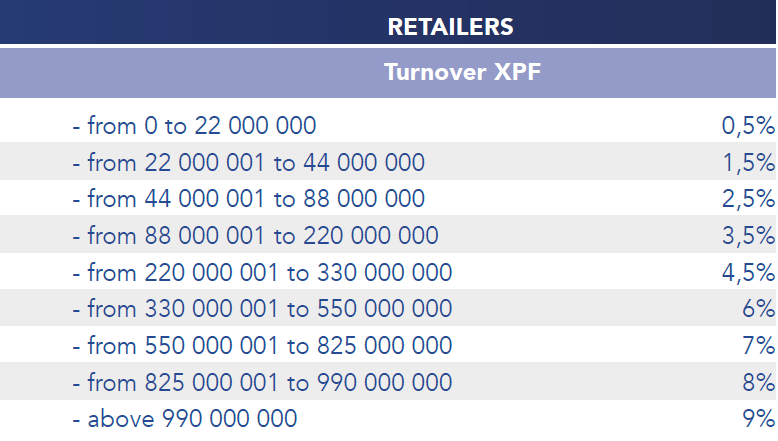

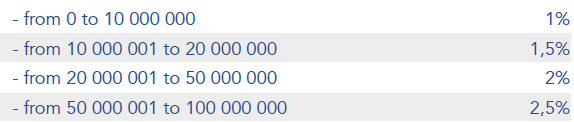

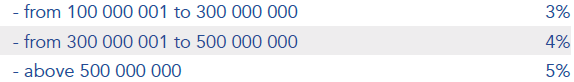

Sole proprietorships are subject to the gross revenue tax if their annual turnover exceeds 10,000,000 XPF. Characterized by simple reporting requirements, this tax applies to the annual turnover as follows:

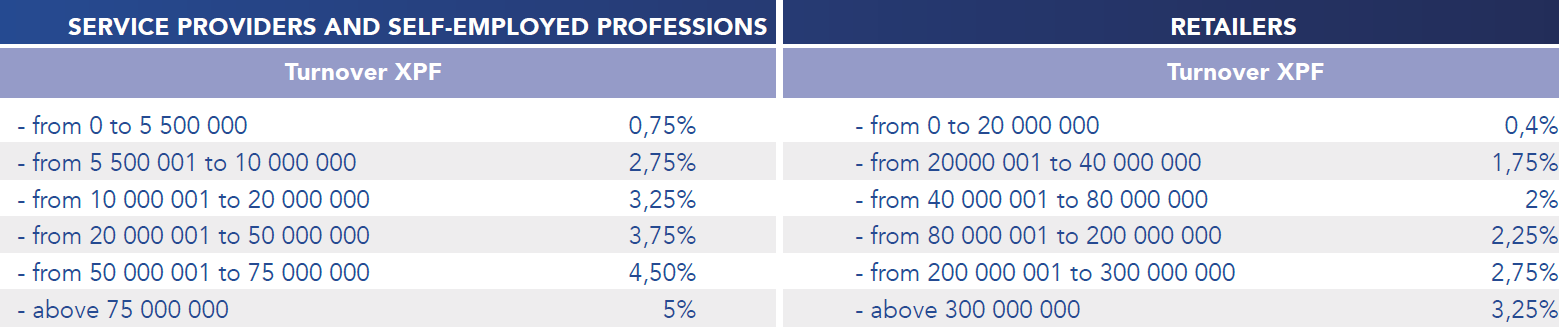

In addition to the gross revenue tax, a territorial solidarity contribution is applied, which also applies to the turnover, according to the following terms:

The gross revenue tax and the contribution also apply to certain types of legal entities (general partnerships, civil societies, limited partnerships).

There are deductions available on the tax base and/or the tax itself, depending on the nature of the activities.

Special cases specific to sole proprietorships:

2-2-1. Primary sector:

Sole proprietorships operating in the primary sector benefit from a very special status, with a wide range of activities exempt from the business tax and gross revenue tax. Similar to individuals receiving salaries, wages and pensions, these businesses in the primary sector are only subject to a territorial solidarity contribution, which applies to their turnover after a 50% deduction. The rates for this contribution are as follows:

In addition to this contribution, pearl and shellfish businesses are subject to a specific gross revenue tax, which applies to their turnover. The rates for this tax are the same as those for the territorial solidarity contribution mentioned above.

Small businesses:

Sole proprietorships, other than those in the primary sector, with an annual turnover not exceeding 10,000,000 XPF, benefit from a simplified tax regime.

This regime involves the application of an annual flat fee, which relieves the business from the business tax and gross revenue tax, thus exempting eligible businesses from related reporting obligations:

|

Businesses whose turnover is less than or equal to 2,000,000 XPF |

25,000 XPF |

|

Businesses whose turnover is between 2,000,001 and 5,000,000 XPF |

45,000 XPF |

|

Businesses whose turnover is between 5,000,001 and 7,500,000 XPF |

110,000 XPF |

|

Businesses whose turnover is between 7,500,001 and 10,000,000 XPF |

200,000 XPF |

Corporate tax: a significant reduced tax burden

Capital companies (public limited companies, limited partnerships by shares, limited liability companies), as well as public institutions with financial autonomy (EPIC), are subject to corporate income tax at a rate of 25%.

However, it should be noted that:

The minimum flat-rate tax replaces corporate income tax when the legal entity is exempt from paying corporate tax due to a reported deficit or when its tax liability exceeds the corporate tax due for fiscal year in question. In this case, the minimum tax is 0.5% of turnover, and in the case of a deficit, the minimum flat-rate tax is 0.25% of turnover, with a minimum payable of 50,000 XPF and a maximum limit of 4,000,000 XPF.

Companies with profits equals to or exceeding 50,000,000 XPF are required, in addition to corporate income tax, to pay an additional corporate income tax contribution, according to the following terms:

Profit: |

|

from 0 to 49,999,999 XPF: |

0% |

|

from 50,000,000 to 100,000,000 XPF: |

7% |

|

from 100,000,001 to 200,000,000 XPF: |

10% |

|

from 200,000,001 to 400,000,000 XPF: |

12% |

|

above 400,000,001 XPF: |

15% |

Special cases related to the business tax (patentes), gross revenue tax, corporate tax, and the SME regime

Individuals who create a new business are exempt from the flat-rate tax for the year of its creation and the following two years. The exemption is conditional on the person having registered their business within three months of starting operations.

Disabled individuals (categories A and B) are exempt form the contribution during their first two years of activity. They permanently benefit from a reduction of 33% (category A) and 66% (category B).

2-2-2. Taxation of businesses not established in french polynesia

Companies that carry out taxable operations in French Polynesia on a one-off basis without being established or represented there are subject to a withholding tax of 15% on the price of these operations. Polynesian clients are required to withhold this amount when making payment. If operations carried out by these companies in French Polynesia are spread over time (for example, a construction project), they may opt for tax representation, which would be subject them to the standard taxes (instead of withholding tax) through a local tax representative accredited by the tax authorities.

3. consumption and related taxes

3-1. value added tax (VAT)

VAT is intented to apply to all goods deliveries and services rendered in French Polynesia. This tax is applied to the price excluding tax of the transactions. Business are required to periodically remit the tax collected, after deducting the tax they have paid on their expenses and investments.

In addition to the exemptions, the applicable rates are 5%, 13% and 16% :

- The reduced rate (5%) applies, in particular, to transactions involving water, non-alcoholic beverages, products intented for human consumption (except basic necessities, which are exempt), medications (except reimbursable medicines, which are exempt), books and press publications (both paper and online), special equipment for disabled individuals and pet food.

This rate also applies to services such as hotel accomodation (including cruise and charter ships, excluding luxury villas), passenger transport, electricity supply, childcare services and certain tourism services ;

- The intermediate rate (13%) applies to all services not specifically exempt and not falling under the reduced rate ;

- The standard rate (16%) applies to all goods deliveries not specifically exempt and not falling under the reduced rate.

3-2. other comsumption taxes

3-2-1. tourism taxation

The tourism promotion fee is a tax applied to land-based tourists. It is charged at a rate of 5% on the sale price of rooms in hotels and international tourist residences.

The cruise development tax applies to passengers of cruise ships that operate regularly or occasionally in French Polynesia. It is 500 XPF per passenger per port call. A sliding scale system is in place to benefit ships that operate permanently in French Polynesia.

3-2-2. advertising taxes

The dissemination of advertising messages on any medium is subject to a specific tax. However, since 2018, only advertising related to products that are also subject to the prevention tax (such as alcohol and sugary products) is taxed at a rate of 40%. Any other form of advertising is now exempt from these taxes.

4. various taxes

4-1. tax on income from movable capital

This tax applies to profits distributed by capital companies, including attendance fees and interests paid to individuals other than banking institutions. It is withheld at source by the company when the payment is made. The profits of companies whose headquarters are located outside of French Polynesia but that operates within the territory are also subject to this tax, in proportion to their activity within the territory.

The tax rates are 12% for income derived from payments to creditors and bondholders, 10% for general distributions, and 4% for interest and earnings from deposits, government bonds and tresury bills.

In addition to this tax, a territorial solidarity contribution of 5% is applied.

For any additional information

Import duties and taxes :

REGIONAL CUSTOMS DIRECTORATE

Various taxes, duties and levies other than registration and transcription duties:

DIRECTORATE OF TAXES AND PUBLIC CONTRIBUTIONS

Registration and transcription duties:

DIRECTORATE OF LAND AFFAIRS

MORGAGE REGISTRY REVENUE REGISTRY

4-2. Property tax on built properties

This tax applies to all built properties, as well as land used for commercial or industrial purposes, and to commercial or industrial installations that are considered as constructions. It is levied at a rate of 10% on the rental value of taxable properties. In addition to the calculated tax, municipal fees are added, which can reprensent an increase of up to 50%.

Temporary exemptions from property tax on built properties:

New constructions, reconstructions and additions to buildings, when regularly declared, benefit from:

After this period, they are taxed in full starting from the 9th year.

4-3. Registration and transcription duties

Registration duties generally apply to all acts of civil life. There are fixed fees and proportional rates. For example, for the creation of companies, the duty is 1% of the share capital, with a minimum amout of 10,000 XPF required. For real estate transactions, including the transcription duty, the cumulative standard rates are 9% on the portion of the price up to 25,000,000 XPF and 11% on the portion above that amount.