The main investment incentives measures

Structuring investment projects carried out in French Polynesia can benfit, under certain conditions, from public support measures through, on one hand, the Polynesian tax exemption scheme or incentive measures for major investments, and on the other hand, the national tax exemption system.

Depending on the sector, investors may also benefit from operational assistance (tax or parafiscal exemption measures), which vary from one industry to another.

1. national tax exemption

The French State supports the economic development of French Polynesia through a tax exemption system specific to the region (Overseas Tax Exemption or LODEOM).

This fiscal aid scheme applies to investments madi in overseas territories in so-called “productive” sectors and “housing” projects. The “housing” category mainly refers to the construction of new residential properties for primary residence, benefiting individuals whose income does not exceed certain thresholds.

Exclusions concern, amoung others, commercial activities, restaurants (excluding classified, tourism restaurants), consulting or expertise services, research and development, education, healthcare, banking, finance and insurance, as well as non-profit activities, postal services, sports and cultural activities, etc.

The tax benefit applies to taxpayers domicilied in mainland France who contribute to financing eligible investments.

Financial benefits:

*Based on the pre-tax amount of eligible investments.

2. polynesian tax exemption

The tax incentive measures for investment outlined in the Investment Code of French Polynesia from a support system to promote the development of major projects. This system significantly reduces the financial burden on project developers.

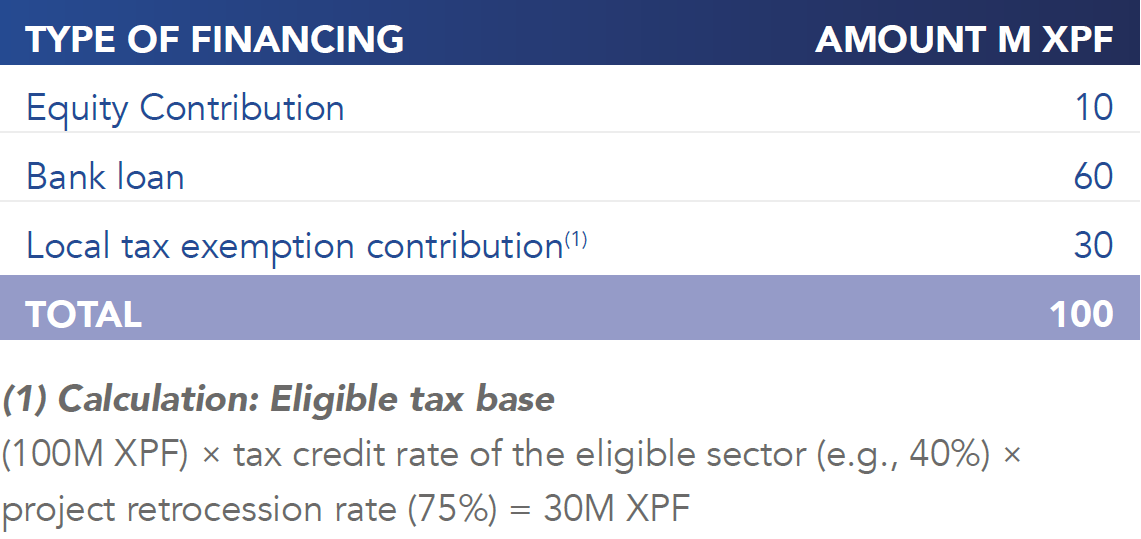

It allows them to benefit from financial participation from third-party companies, covering an amount between 22.5% and 30% (depending on the sector) of the eligible investment amount excluding tax. In return these companies are entitled to a tax credit ranging from 30% to 40% of the eligible base portion invested, which they pass on at least 75% to the project developers, resulting in a maximum tax gain of 30% of the actual amounts invested.

IN ITS IMPLEMENTATION, THE POLYNESIAN TAX EXEMPTION SYSTEM OFFERS TWO REGIMES:

2-1-1. INDIRECT INVESTMENTS

Investments made in French Polynesia may be eligible for the tax exemption system, provided specific criteria related to the sector of activity are met. Individuals or entities liable for corporate tax or gross revenue tax, who participate in financing investments programs in one of the eligible secotrs approved by French Polynesia, benefit, under certain conditions, from a tax credit.

2-1-2. DIRECT INVESTEMENTS

Corporate entities are subject to corporate tax or gross revenue tax can benefit from a tax advantage, in the form of a reduction in corporate tax, income tax on movable capital or on rights and taxes, when they directly carry out and finance an investment program approved by the council of ministers, without resorting to third-party investors.

To benefit from this tax advantage, the investment program must be approved by the Council of Ministers. After the approval, the project owner calls upon “tax-exempt investors” (individuals or entities subject to gross revenue tax or corporate tax in French Polynesia) who, in return for their contributions to financing the project, benefit from a tax credit that can be applied in the fiscal year during which the financing occurs, with the remaining balance applied over the next fiscal year.

In summary:

To benefit from the investment regimes provided under the Title I of Part II of the Investment Code (Polynesian tax exemption) and to request approval under the conditions of Chapter II of Title II, companies must be selected following a call for expressions of interest procedure.

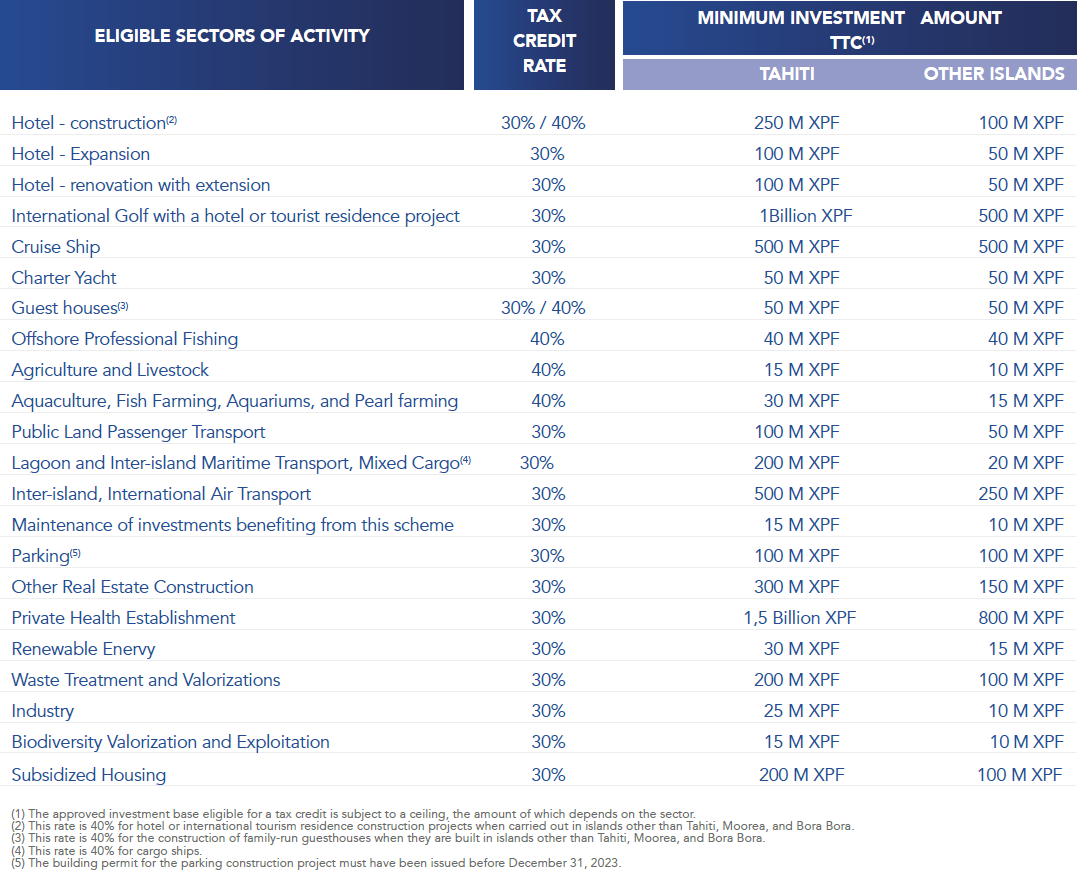

AN INVESTMENT PROJECT CARRIED OUT IN FRENCH POLYNESIA IS ELIGIBLE IF IT FALLS UNDER THE FOLLOWING SECTORS OF ACTIVITY:

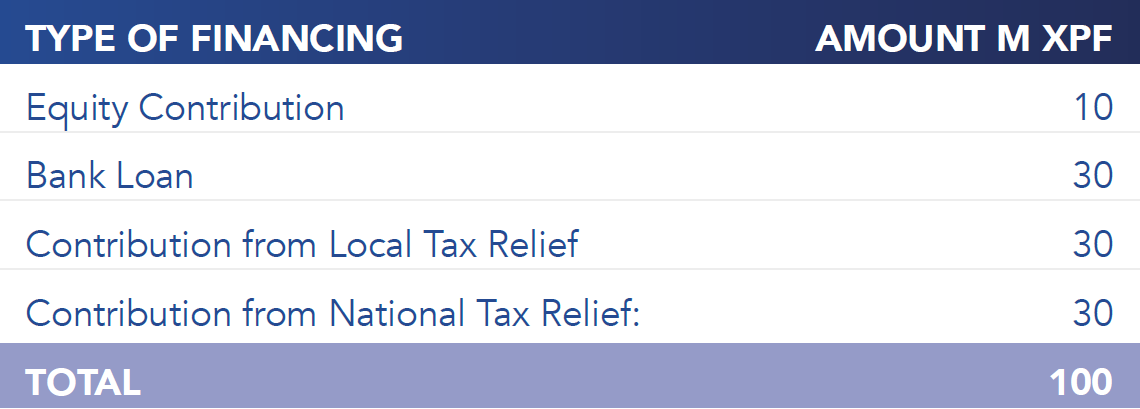

3. COMBINATION OF THE TAX EXEMPTION SYSTEMS

Subject to project eligibility for both schemes, project sponsors can benefit from the combined support of both tax exemption schemes. They must submit their application to the AMI (Polynesian tax exemption) and to the DGFIP in Paris (National tax exemption).

By combining both schemes, depending on the sector, it is possible to obtain more than 52.4% of aid on the eligible investment amount (75% of the 30% Polynesian tax credit + 66% of the 45.3% national tax reduction, minus the application fees).

4. the tax incentive system for large investments

In order to encourage large-scale investments that generate jobs in French Polynesia, a system consisting of long-term tax exemptions has been implemented by the government, alongside the tax relief program.

To benefit from this system, investment programs must be carried out in the strictly defined Priority Development Zones (ZDP) and are subject, like the tax relief program, to approval by the Council of Ministers of French Polynesia.

The minimum investment threshold is 10 billion XPF.

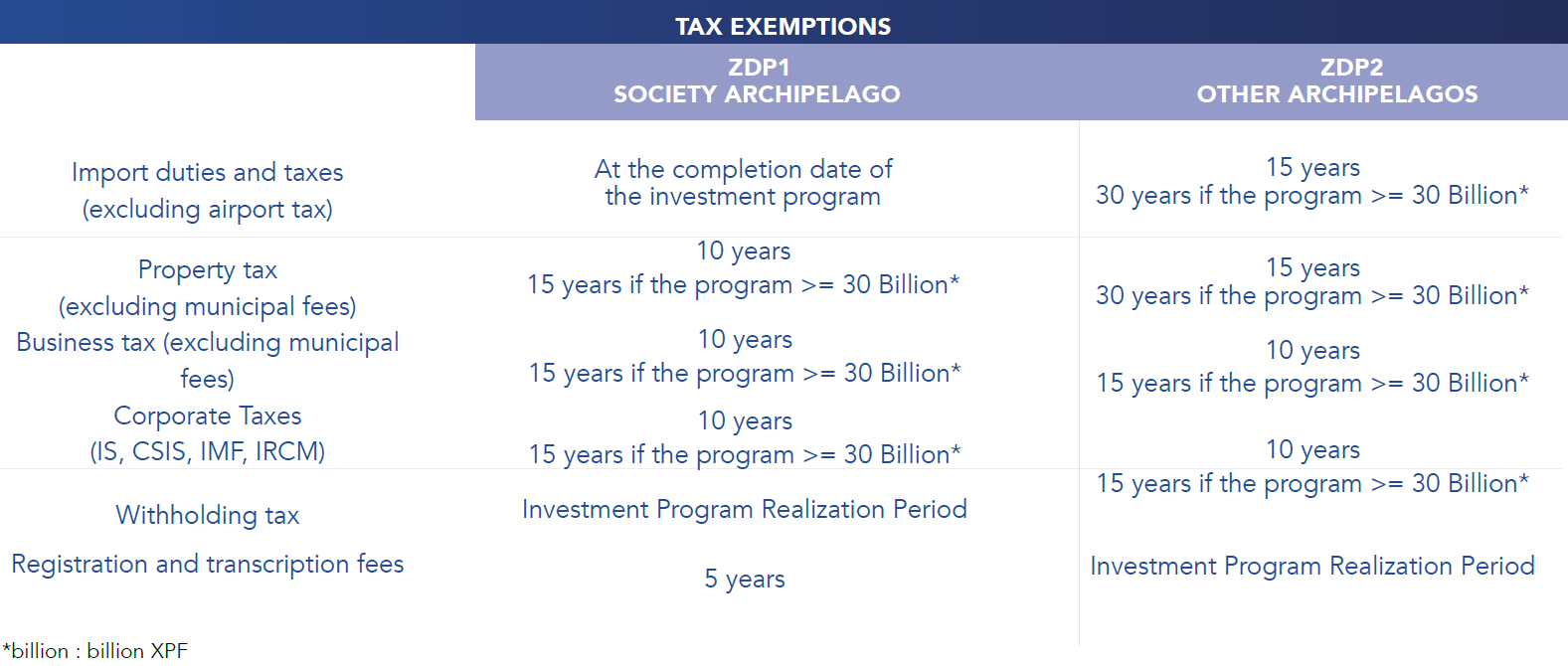

The system provides for two types of ZDPs, which will determine the duration of the tax exemptions: ZDP1 (islands of the Society Archipelago) and ZDP2 (islands of the other arcipelagos).

The approval of investment programs is subject to meeting certain conditions, including the feasibility of the proposed investments and the creation of jobs. The investment approval decree specifies the exemptions on imports as well as the internal regiùe exemptions granted.

THE SYSTEM GUARANTEES LONG-TERM TAX EXEMPTIONS UNDER THE FOLLOWING CONDITIONS:

In order to reduce transportation costs due to geographical remoteness, the scheme extends the exemptions from the import duties and taxes to diesel fuel, upon request from the investor.

Important: This scheme is not cumulative with the Polynesian tax exemption scheme. However, it can be combined with the national tax exemption scheme if the investment project falls within an eligible sector.

processing of applications

The Economic Development Agency is primarly responsible for:

> Receiving the application files submitted as part of the Call for Expression of Interest (AMI) procedure and forwarding them to the Tax and Public Revenue Directorate (DICP).

The tax and Public Revenue Directorate is primarly responsible for:

> Processing requests for approval under the tax incentives measures ;

> Verifying the eligibility of the investment program under the relevant sector and ensuring that the application is complete with respect to the required documentation for approval.